Trending Now

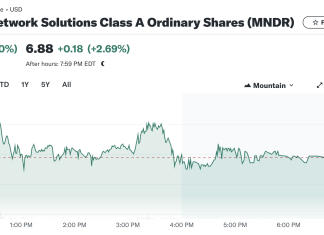

Mobile-health Network Solutions (MNDR) Goes Public: A Closer Look for Traders...

Mobile-health Network Solutions (MNDR), a prominent provider of telehealth solutions based in Singapore, recently announced the pricing of its initial public offering...

Oragenics Positions ONP-002 as Potential First-Ever Pharmacological Treatment for Concussion in...

Oragenics, Inc. (NYSE American: OGEN), a clinical-stage biotechnology company developing brain-targeted therapeutics through proprietary intranasal delivery technology, has laid out an ambitious...

Warren Buffett Might Be Trimming His Apple Holdings Again — And...

If you've been following Warren Buffett's moves lately, you might have noticed something interesting buried in Berkshire...

CRYPTO NEWS

Jaguar Health (JAGX) Secures Exclusive Rights to Gelclair in Strategic Move...

In a significant stride towards expanding its cancer care portfolio, Jaguar Health, Inc. (NASDAQ: JAGX) announced a strategic partnership with the UK-based...

TRENDING

LATEST REVIEWS

President Joe Biden Proposes $1.9 Trillion Relief Bill Which Could Benefit...

US President Joe Biden has shot down Republican’s proposal for a $618 million COVID-19 relief bill to help struggling American businesses and...

Hot Of the Press

Treatment.com AI Inc (CSE: TRUE) Revolutionizing Healthcare Through AI and Education

The global artificial intelligence (AI) in healthcare market size was estimated at USD 15.1 billion in 2022 and it is expected to...

STOCK NEWS

Reddit Deploys Arbitrum Layer 2 Solution to Scale Ethereum Community Points

During the recent cryptocurrency hype, popular community-based social media Reddit was searching for a way to be a part of this trend by leveraging...

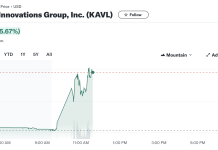

Is the market showing a delayed response to Kaival Brands Innovations Group (NASDAQ: KAVL)...

Kaival Brands Innovations Group, Inc. (NASDAQ: KAVL), a key player in the distribution of electronic nicotine delivery systems (ENDS), recently shared its...

Apple Co-Founder Steve Wozniak Sues Youtube Over Crypto Scams

Apple co-founder, Steve Wozniak, sued YouTube and its parent company, Google, to continually allow scammy and phishing bitcoin giveaways to use his likeness. Wozniak...

Microstrategy Raises $650 Million From Convertible Bond Sale for Bitcoin Purchase

Business intelligence company, Microstrategy (MSTR) has announced that it raised $650 million from convertible bonds sale to finance additional Bitcoin (BTC) purchases. The bond...

SPY ready to close red into the weekend

The market made a big move higher yesterday and kept running up to all time after-market highs above 328 before coming...