BlackRock Dives Deeper into Crypto: Launches Bitcoin Fund and Explores Ethereum...

During a recent discussion at the Bitcoin Investor Day event held in New York, Robert Mitchnick, the lead for digital asset strategies...

Bitcoin Snaps Back to $69K in Short Squeeze — Analysts Warn...

Bitcoin surged back near $69,000 on Wednesday, rallying more than 10% from Tuesday's low as crypto markets staged a broad relief rally...

Oragenics Positions ONP-002 as Potential First-Ever Pharmacological Treatment for Concussion in...

Oragenics, Inc. (NYSE American: OGEN), a clinical-stage biotechnology company developing brain-targeted therapeutics through proprietary intranasal delivery technology, has laid out an ambitious...

CRYPTO NEWS

Ether Anticipates a Grand “Merge” and Hopes to Beat Bitcoin

Several crypto watchers have been discussing the melding of Ethereum's EH1 chain with a new chain. The anticipated outcome would be the creation of...

TRENDING

LATEST REVIEWS

Paypal Holdings Inc (NASDAQ: PYPL) Set to Unveil Crypto Trading for...

On Wednesday, Paypal Holdings Inc (NASDAQ: PYPL) held its second-quarter earnings call, and CEO Dan Schulman had a few observations to make. The leader...

Hot Of the Press

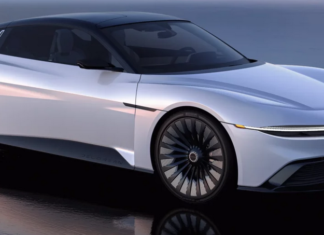

DeLorean Motor Company Files Two Applications For NFT Patents

As the Metaverse slowly becomes a reality, many artists, institutions and companies are developing Non-fungible tokens to help them communicate with their customers in...

STOCK NEWS

Maps.Me Raises $50 Million To Embed Decentralized Finance Protocols On Its Platform

Offline travel and mapping application Maps.Me which boasts over 140 million users globally has raised $50 million to integrate decentralized finance (DeFi)...

MonoX Announces Launch of Mainnet On Polygon and Ethereum

MonoX has announced the public launch of the mainnet with liquidity and swap features on Polygon and Ethereum. The launch comes after MonoX raised...

Nvidia and Other Chip Stocks take a beating and here’s why

Whoa, what a wild ride in the markets! It felt like a rollercoaster this week, with some stocks soaring and others taking...

US Federal Reserve Publishes Research Exploring Value Of CBDC

With discussions on Central Bank Digital Currencies increasingly becoming popular, the US Federal Reserve is widening its research on CBDCs to identify the inherent...

Binance and eToro Join Cryptocurrency Exchanges In Delisting XRP Trading Following SEC Lawsuit Against...

The number of US crypto exchanges suspending XRP token trading continues to increase following SEC’s lawsuit against Ripple Labs, the token developer. After the...