CareDx, Inc. (CDNA): A Comprehensive Analysis for Investors and Traders

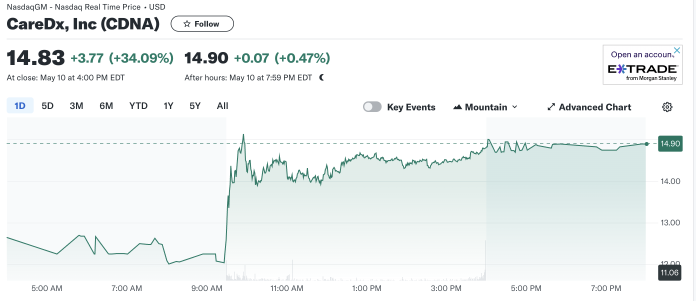

CareDx, Inc. (NASDAQ: CDNA), a pioneer in the field of transplant diagnostics, has recently shared its financial results for the first quarter of 2024, revealing a mix of challenges and achievements that are pivotal for investors and traders to understand. With a closing stock price of $14.83 on May 10, marking a significant 34.09% increase, followed by a modest after-hours rise, CareDx has demonstrated volatility that requires a nuanced analysis.

Financial Performance Breakdown

In the first quarter of 2024, CareDx reported revenues of $72.0 million. This figure represents a 7% decrease compared to the $77.3 million from the first quarter of 2023 but shows a promising 10% increase from the fourth quarter of 2023. The company’s Testing Services, the core of its revenue generation, brought in $53.8 million. Despite a 13% decrease year-over-year, this sector experienced a robust 15% growth from the previous quarter, driven by improved revenue cycle management and recovery of unpaid claims, which added approximately $3.7 million to the revenue.

The company reported providing total AlloSure® and AlloMap® patient results of approximately 42,000 for the quarter, a 16% decrease year-over-year but a 6% increase sequentially. This suggests a rebound in testing volume, which is a positive signal for the company’s operational recovery.

Operational Highlights and Strategic Advancements

CareDx showcased over 30 oral presentations and held two symposia at the International Society for Heart and Lung Transplantation (ISHLT), underscoring its commitment to scientific advancement in heart and lung transplantation. A notable highlight from these events was the presentation of SHORE data, which demonstrated that its HeartCare® multimodal testing significantly outperforms traditional donor-derived cell-free DNA testing in detecting allograft rejection.

Furthermore, the expansion of payer coverage by 14 million lives nationwide is a strategic move that could significantly enhance CareDx’s market reach and customer base.

Market Implications and Investor Considerations

For investors, the stock’s recent surge and the after-hours stability suggest a market response that is cautiously optimistic about CareDx’s strategic direction and recovery in testing volumes. The company’s management has expressed confidence, reflected in the upward revision of the full-year 2024 revenue guidance to between $274 million and $282 million.

However, the company’s financial health, as indicated by a net loss of $16.7 million for the quarter, although improved from a net loss of $23.7 million in the previous year, still poses a risk. The reduced net loss per share from $0.44 to $0.32 and a narrower non-GAAP net loss suggest improving efficiency and potentially, a path to profitability.

Conclusion

For traders, the volatility in CareDx’s stock offers both risk and opportunity, particularly in the short term. Investors, on the other hand, should weigh the company’s strategic advancements and improved operational metrics against the backdrop of its financial losses and the competitive landscape of the healthcare sector.

In conclusion, while CareDx faces challenges, its strategic initiatives, particularly in enhancing diagnostic accuracy and expanding payer coverage, alongside a clear focus on improving financial health, lay down a promising path forward. As such, both traders and long-term investors should keep a close eye on CareDx’s operational strategies and market performance to make informed decisions.