In a significant stride towards expanding its cancer care portfolio, Jaguar Health, Inc. (NASDAQ: JAGX) announced a strategic partnership with the UK-based Venture Life Group PLC. The five-year exclusive in-license agreement positions Jaguar to commercialize Gelclair, an FDA-approved product aimed at managing oral mucositis, a common and debilitating side effect of cancer treatments.

Oral mucositis, also known as “chemo mouth,” is a critical concern in oncology, impacting up to 40% of patients undergoing chemotherapy. This condition can escalate to nearly 90% among those treated for head and neck cancers, with severe cases potentially halting cancer therapy due to unbearable pain and complications, according to the National Comprehensive Cancer Network.

Gelclair distinguishes itself from other treatments by not being a numbing agent, which can reduce patient discomfort without the typical stinging sensation found in similar products. This allows patients to continue their nutritional intake normally, a crucial aspect of maintaining strength during treatments like radiation therapy.

“This agreement marks a pivotal moment as we broaden our commitment from HIV to include oncological supportive care,” stated Lisa Conte, President and CEO of Jaguar. Dr. Maged Ghaly, a radiation oncologist at Northwell Health Cancer Institute, emphasized Gelclair’s role in mitigating the severity of mucositis, thus reducing the need for interruptions in cancer treatment.

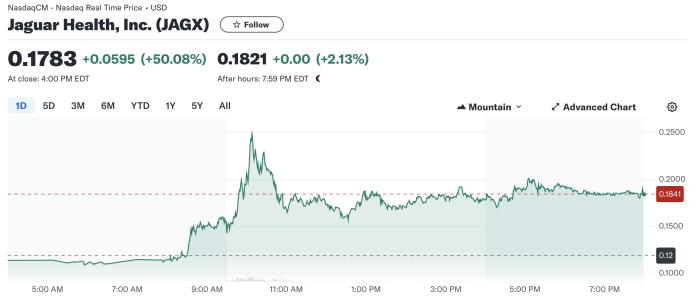

The stock market responded enthusiastically to this news, with Jaguar Health’s stock price surging 50.08% today, closing at $0.1783. This marked increase from the previous close of $0.1188 indicates strong investor confidence in the strategic direction Jaguar is taking. Today’s trading opened at $0.1036, and after reaching a high of $0.2570, the stock saw significant trading volume of nearly 598 million shares, dwarfing the average volume of around 46.5 million shares.

The day’s trading range reflected a broad interest, peaking at significant highs and maintaining strong bids throughout the session. The elevated ask price of $0.2900 suggests that some investors anticipate further upside potential.

From a financial perspective, the in-licensing of Gelclair could be seen as a strategic maneuver to enhance Jaguar’s product offerings in the supportive care market without the burden of additional clinical development costs. This comes as the company anticipates results from its Phase 3 OnTarget trial, which evaluates another promising drug, crofelemer, for chemotherapy-induced overactive bowel.

As the healthcare industry continues to emphasize the quality of life in cancer treatment protocols, products like Gelclair play a crucial role in managing side effects that are often overlooked yet critical to patient care. The agreement not only expands Jaguar’s footprint in the supportive care market but also signals a strong commitment to addressing the comprehensive needs of cancer patients, potentially improving their treatment outcomes and quality of life.

This strategic initiative by Jaguar Health could set a new standard in the management of cancer treatment side effects, providing a blueprint for future developments in the oncology supportive care landscape. As the company moves forward with its diverse pharmaceutical portfolio, stakeholders and patients alike may find new reasons to look towards Jaguar with renewed interest and hope.

Source: https://finance.yahoo.com/quote/JAGX/