In a recent pivotal decision, Agenus Inc. (Nasdaq: AGEN), a leader in immuno-oncology, announced a one-for-twenty reverse stock split approved by its shareholders, effective from April 12, 2024. This strategic move aims to bolster the company’s financial flexibility, ensuring its eligibility for continued listing on the Nasdaq Capital Markets and qualification for inclusion in the Russell Indices. The reverse stock split will maintain the par value of shares at $0.01, adjusting all issued and outstanding shares uniformly, with minimal changes to shareholder percentages, save for necessary adjustments due to fractional share rounding.

Amid these corporate adjustments, Agenus (AGEN) also remains at the forefront of cancer research, ready to present findings from the Phase 1b trial of botensilimab and balstilimab for treating microsatellite stable colorectal cancer at the upcoming ASCO Meeting. This presentation is highly anticipated as it could highlight the efficacy of Agenus’ therapies in specific non-liver metastatic sites, potentially marking a significant step forward in targeted cancer treatment.

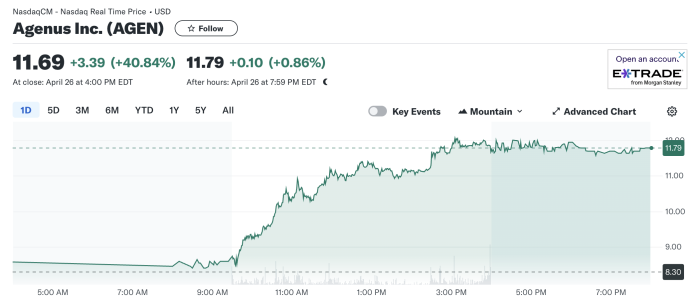

The market has reacted positively to these developments, with Agenus’ stock experiencing significant volatility. On Friday, the stock closed at $11.69, up by 40.84%, with an after-hours increase to $11.79. This marked activity is a clear indicator of growing investor interest and confidence. The trading volume surged to over 3.3 million shares, far exceeding the average, suggesting a robust investor response to both the reverse stock split and clinical trial prospects. The day’s trading saw the stock moving between $8.48 and $12.23, reflecting intense market engagement. This year’s stock performance has seen a wide range, with lows of $4.78 and highs of $42.60, underscoring the biotech sector’s typical volatility and the high stakes involved in biopharmaceutical development.

Investors and traders are keenly watching Agenus, not only for its promising clinical outcomes but also for its strategic corporate maneuvers. These could potentially stabilize its market position and attract a broader investment base, particularly from institutional investors seeking compliance with Nasdaq’s listing standards and those interested in the innovative biotech sector.

As Agenus navigates these operational and clinical milestones, the dual focus on strategic corporate governance and groundbreaking cancer treatments presents a compelling narrative for investors. Those invested or interested in the healthcare and biotech sectors should closely monitor Agenus’ developments, balancing the allure of rapid gains against the sector’s inherent risks and volatilities. As always, potential investors should consult with financial advisors to align such dynamic opportunities with their investment strategies.