Meta Platforms Set to Release First-Quarter Earnings Amid Tech Surge

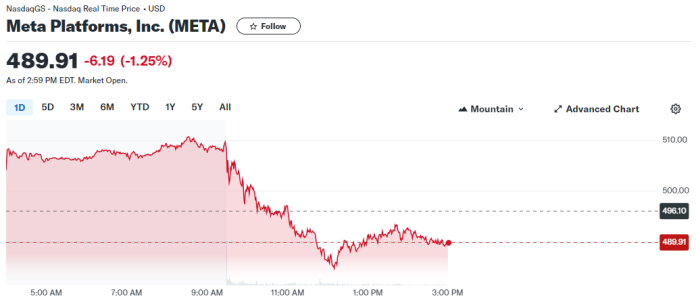

Meta Platforms, the parent company of Facebook, is poised to unveil its first-quarter earnings after Wednesday’s closing bell, amidst a flurry of technology sector releases. The tech behemoth has seen remarkable growth, climbing approximately 40% in 2024, following a staggering 200% surge the previous year. Even amidst the recent market downturn, Meta has managed to outperform, with its stock advancing over 2% in April despite the Nasdaq Composite sliding more than 4%.

This upward trajectory coincides with Meta’s strategic shift towards efficiency and diversification beyond social media into realms such as alternative reality and artificial intelligence technology. With Meta’s stock trading roughly 6% below its all-time high reached earlier in April, investors are eagerly anticipating the latest earnings report.

Previous Earnings Performance

Meta’s fourth-quarter earnings, unveiled in early February, sparked a significant rally in its stock price. Exceeding expectations on both fronts, Meta announced robust guidance for the first quarter, alongside the initiation of a quarterly dividend of 50 cents and a $50 billion stock buyback program. This announcement led to a surge of over 20% in the stock price, marking one of Meta’s most notable daily performances in history.

Expectations and Analyst Insights

Historically, Meta has outperformed Wall Street forecasts approximately 87% of the time, typically resulting in an average gain of 2.3% on earnings days, according to Bespoke Investment Group. Analysts, polled by LSEG, forecast earnings per share of $4.32 and revenue of $36.16 billion for the first quarter, indicating a 26% rise in revenue year over year. The majority of analysts maintain buy ratings on Meta, with price targets suggesting potential share appreciation of over 8% in the next year.

Rohit Kulkarni, Managing Director at Roth MKM, reflects on Meta’s recent performance and ponders whether CEO Mark Zuckerberg can continue to deliver positive surprises. Kulkarni emphasizes caution due to tougher comparable figures and regulatory concerns, particularly in Europe. However, he highlights the potential for significant growth, envisioning a pathway towards mid-teens revenue growth in the fourth quarter and earnings per share surpassing $25 by 2025.

Key Metrics to Watch

Apart from headline figures, analysts will closely monitor various smaller data points to gauge the health of Meta Platforms. Metrics such as total daily active users, minutes per active user, and average revenue per user are crucial indicators of engagement and profitability. Additionally, guidance on full-year capital expenditure spending will provide insights into Meta’s investment strategies for future growth.

As Meta Platforms prepares to unveil its first-quarter earnings, investors remain poised for potential market-moving insights into the company’s performance and strategic direction.