Trio Petroleum Corp (NYSE American: TPET), a burgeoning oil and gas entity based in Bakersfield, California, has recently made headlines with several pivotal updates that hold significant implications for traders and investors alike. As the company navigates through its operational and financial phases, understanding these updates can provide a clearer picture of its trajectory and potential investment opportunities.

Operational Excellence and Expansion

Trio’s recent operational update highlights substantial progress in its oil-producing assets located in Monterey County, California, specifically at the Presidents Field and McCool Ranch. The company has successfully brought the HV-3A well at Presidents Field back to full-time production, with a stabilized output of 30 barrels of oil per day (BOPD). This is a notable increase from its initial peak production of 154 BOPD in 2018. Such results suggest that Trio’s asset revitalization strategies are bearing fruit, positioning it well for future expansions.

Moreover, at McCool Ranch, the HH-1 Well continues to produce approximately 45 BOPD. Additional wells in this field, including the newly reactivated 35X well, are expected to contribute further to the company’s daily production rates. These operational successes underscore Trio’s ability to enhance output efficiently, an appealing factor for investors looking for companies with proven capability in asset management and development.

Financial Restructuring and Strategic Acquisitions

Financially, Trio has taken robust steps to solidify its footing. The retirement of $2.6 million in outstanding convertible notes marks a strategic move towards strengthening its balance sheet. This decision follows the acquisition of the McCool Ranch Field and the resumption of production at key wells, which have collectively kickstarted cash flows and buoyed investor confidence.

The ability of Trio’s management to negotiate and retire convertible debt rapidly reflects a proactive approach to financial management, which is crucial for sustaining operations and funding future expansions. This is particularly relevant as the company eyes further development opportunities within its existing assets and new ventures like the Asphalt Ridge project in Uinta County, Utah.

Investment Considerations

For traders and investors, Trio Petroleum offers a multifaceted investment narrative:

- Operational Growth: The company’s effective management and expansion of its oil fields suggest potential for increased production and, consequently, higher revenues.

- Financial Prudence: The swift action in improving its financial structure by retiring debt enhances its creditworthiness and reduces risk for investors.

- Strategic Investments: Trio’s ongoing and planned investments in both operational infrastructure and new projects are set to create multiple streams of income, diversifying its portfolio and potentially increasing its market valuation.

Trio Petroleum Corp stands out as a company with a clear strategic direction, demonstrated by its operational successes and tactical financial maneuvers. For traders and investors focused on the energy sector, particularly in oil and gas, TPET presents a compelling case for consideration. Its current activities and future plans could very well translate into substantial value creation, making it a noteworthy addition to investment portfolios focused on energy and natural resources.

As Trio continues to navigate the complexities of the oil market and its financial landscape, keeping a close eye on its operational and financial health will be key in assessing its long-term investment potential.

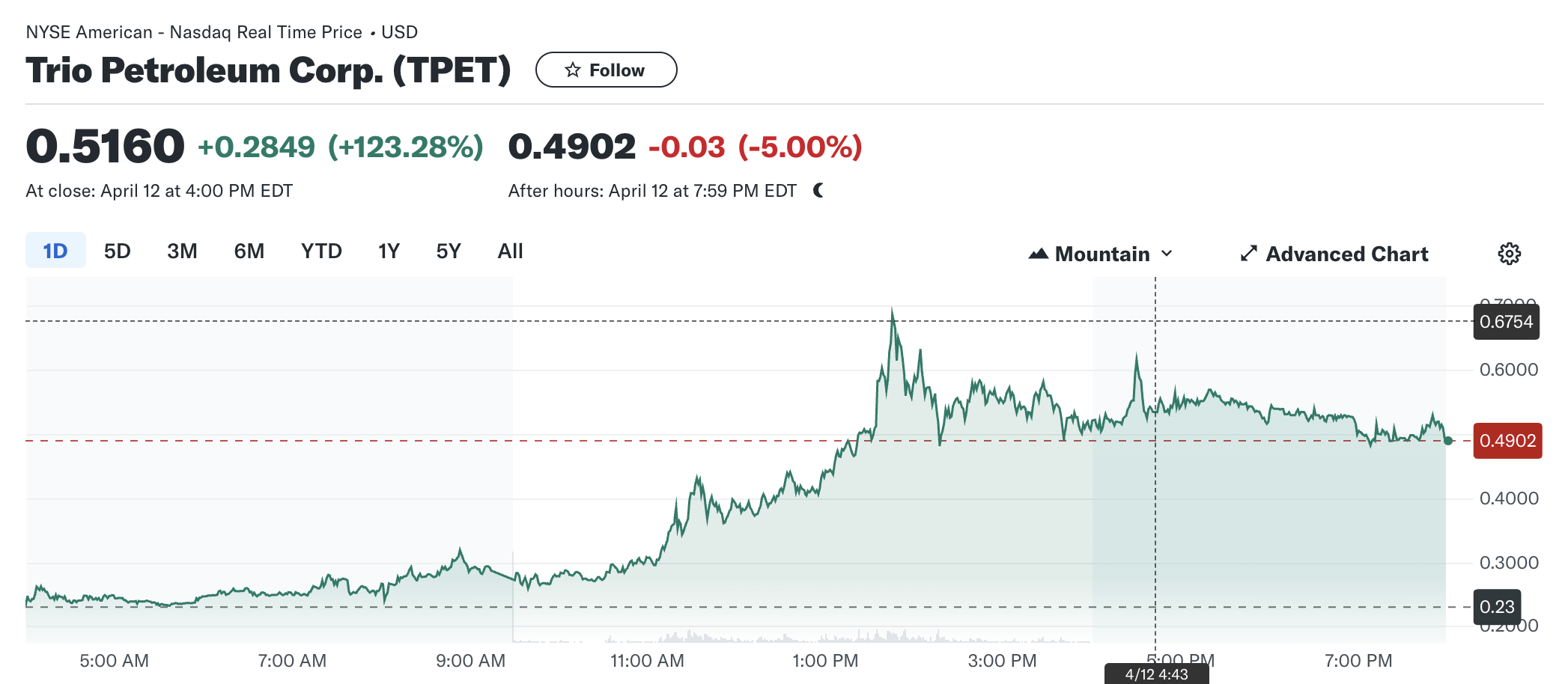

Trio Petroleum Corp (TPET) has recently seen a significant increase in its stock performance, closing its last trading session at $0.5160, marking a sharp rise of $0.2849 or 123.28% from the previous close of $0.2311. The stock opened the day at $0.2800, fluctuating between a low of $0.2600 and a high of $0.6939 throughout the trading day. The bid price stood at $0.4900 with a size of 900 shares, while the ask was slightly higher at $0.4903 for 1200 shares. Notably, the trading volume was extraordinarily high at 328,790,680 shares, compared to an average volume of 15,056,780, indicating a significant investor interest. TPET’s performance this year has ranged from a low of $0.0800 to a high of $3.0000, reflecting its volatility and the broad interest of the market in this stock.