In a significant development for traders and investors, penny stock Beneficient (Nasdaq: BENF), last month, had revealed its plan to provide liquidity solutions to three separate funds managed by ff Venture Capital. This arrangement could signal new opportunities and a fresh approach to handling alternative assets.

Details of the Deal

The deal centers around Beneficient’s agreement to finance liquidity transactions that could total up to $62 million in the form of Resettable Convertible Preferred Stock. This stock is convertible at the option of the holder into Beneficient’s Class A common stock, coupled with potential earnout payments over a decade. The aim is to offer limited partners in ff Venture Capital’s funds an innovative method to achieve liquidity on their investments in alternative assets.

Strategic Importance

The significance of this transaction extends beyond the immediate liquidity it provides. By potentially increasing the collateral for Ben’s loan portfolio by up to $121.5 million, the deal underscores a robust strategy to enhance asset-backed lending capabilities. This strategic move not only strengthens Beneficient’s balance sheet but also diversifies its exposure and investment portfolio.

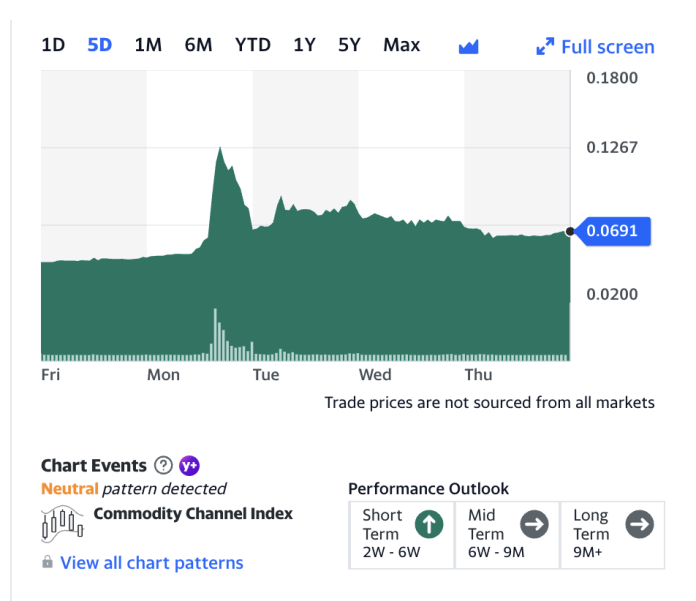

Recent Trading Activity

Beneficient’s stock has been particularly active, reflecting investor reactions to the announced transactions. Yesterday’s trading session saw the following:

- Previous Close: $0.0764

- Open: $0.0710

- Day’s Range: $0.0640 – $0.0731

- 52 Week Range: $0.0480 – $16.5000

- Volume: 18,910,889

- Average Volume: 6,444,165

Despite a lack of current bids and a modest asking price ($0.0691 x 100), the heightened trading volume, nearly three times the average, indicates significant investor interest.

Market Impact

For traders, the implications of this deal are twofold. First, the increased collateral base may bolster Beneficient’s credit profile, potentially enhancing its attractiveness to investors. Second, the introduction of new financial instruments such as the Preferred Stock provides a novel trading opportunity, particularly for those focused on convertible securities.

Management Insights

Brad Heppner, CEO of Beneficient, emphasized the flexibility and customized solutions that this deal represents for managing general and limited partner expectations and financial needs. John Frankel, Founding Partner of ff Venture Capital, also highlighted the creative liquidity solutions being made available to limited partners, which could set a precedent in the venture capital industry for alternative asset management.

About Beneficient

Beneficient aims to democratize the alternative asset investment market, offering liquidity solutions to mid-to-high net worth individuals and smaller institutional investors. This is facilitated through innovative tools like AltQuote™ and digital platforms like AltAccess® that enhance the efficiency and transparency of liquidity transactions.

Regulatory and Legal Considerations

It’s crucial for traders to note that the Preferred Stock involved has not been registered under the Securities Act of 1933, as amended, indicating that these securities are subject to specific trading and investment restrictions. The finalization of this deal is pending shareholder approval and other regulatory conditions, which suggests that close monitoring of these proceedings will be essential for interested parties.

Conclusion

This partnership between Beneficient and ff Venture Capital could be a watershed moment for the treatment of alternative assets in the financial markets. Traders should watch this space closely, as the successful execution of this deal could lead to similar arrangements in the future, potentially reshaping the landscape of alternative asset management and liquidity provision.

Disclaimer

This blog post is for informational purposes only and does not constitute financial advice or a solicitation to buy or sell any securities. Investors should conduct their own research or consult a financial advisor before making investment decisions.