Mobile-health Network Solutions (MNDR), a prominent provider of telehealth solutions based in Singapore, recently announced the pricing of its initial public offering (IPO) at $4.00 per share. This offering includes 2,250,000 Class A Ordinary Shares, with an additional over-allotment option for the underwriter that could bring the total to 2,587,500 shares. This news is particularly relevant for traders and investors looking to understand the implications of MNDR’s market debut.

Key IPO Details

MNDR’s shares are set to begin trading on NASDAQ under the ticker “MNDR” starting April 10, 2024. The IPO is priced at $4.00 per share, with potential gross proceeds up to $10.35 million if the over-allotment is fully exercised. This capital infusion could play a crucial role in scaling MNDR’s operations, particularly its MaNaDr platform which offers comprehensive telehealth services across the APAC region.

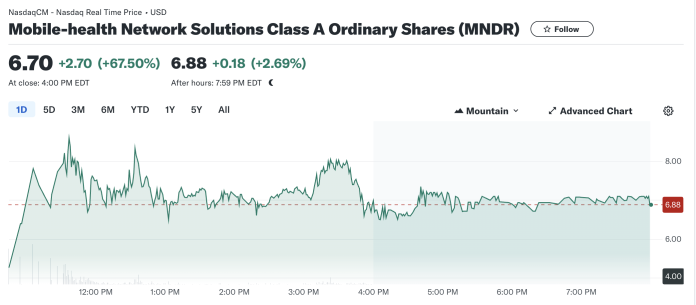

The company’s shares opened strongly, trading at $4.79, and saw a high of $8.79, indicating robust initial interest. This movement reflects a significant premium over the IPO price, showcasing investor confidence and the potential underestimation of the offering price by the market.

Trading Performance and Investor Sentiment

On its first day, MNDR’s trading volume reached 5,648,281 shares, demonstrating high liquidity and investor interest. The stock’s substantial day range, from $4.79 to $8.79, provides early traders with profitable short-term trading opportunities, particularly if leveraging the IPO’s volatility.

Investors should note the company’s valuation dynamics and the broader market conditions affecting tech and healthcare stocks. With MNDR operating at the intersection of these industries, it is positioned to benefit from the growing demand for telehealth services—a sector that has seen accelerated growth due to global shifts towards digital health solutions.

Strategic Considerations for Investors

When evaluating MNDR as a potential investment, consider the following:

- Growth Potential: The telehealth market is expanding rapidly. MNDR’s established presence and operational model could leverage this growth, particularly in under-served markets within the APAC region.

- Financial Health: Proceeds from the IPO are expected to fund further development and expansion of MNDR’s services, which could enhance long-term shareholder value.

- Market Sentiment: Early trading activity suggests a positive market sentiment towards MNDR. However, investors should watch for fluctuations as the market stabilizes post-IPO.

For those considering adding MNDR to their portfolios, it’s crucial to keep an eye on the company’s post-IPO performance and any further announcements regarding their operations and financial health. The significant interest shown by investors on the opening day may be a positive indicator, but as always, potential investors should conduct thorough due diligence and consider their investment strategy and risk tolerance.

MNDR’s entry into the market marks an exciting phase for stakeholders and provides a fresh avenue for investors keen on the digital and health technology spaces. With its innovative platform and strategic market positioning, MNDR stands out as a noteworthy contender in the burgeoning telehealth industry.