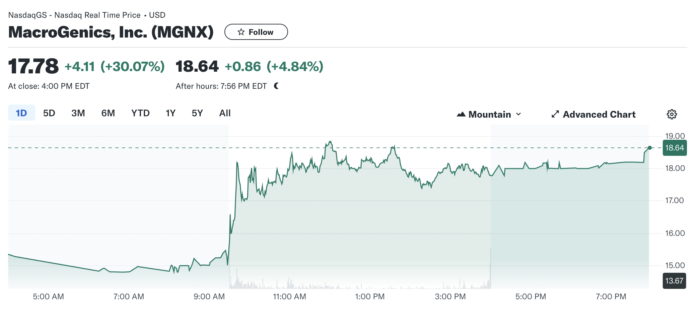

Today, MacroGenics, Inc (NASDAQ: MGNX) stock experienced a significant uptick in its trading performance amidst active trading. Closing the day at $17.78, the stock saw an impressive gain of $4.11, which translates to a 30.07% increase by the end of the trading session at 4:00 PM EDT. The positive momentum continued into after-hours trading, with the stock advancing further to $18.64, up by an additional $0.86 or 4.84% as of 7:56 PM EDT. This surge in the stock’s price is particularly noteworthy considering its 52-week range of $4.29 to $21.88, suggesting a strong rebound and investor confidence. Furthermore, today’s volume of 6,803,992 shares traded is significantly higher than the average volume of 1,443,104 shares, indicating heightened interest and activity in MacroGenics’ stock. This remarkable performance underscores the market’s optimistic response, potentially fueled by recent company updates or broader investor sentiments.

In the dynamic world of biopharmaceuticals, where innovation and investment converge, MacroGenics, Inc. (NASDAQ: MGNX) stands out with its focus on crafting novel antibody-based therapeutics aimed at cancer treatment. On April 3, 2024, the company shared insights into the ongoing Phase 2 TAMARACK study of vobramitamab duocarmazine (vobra duo, previously known as MGC018), specifically targeting patients with metastatic castration-resistant prostate cancer (mCRPC).

This update comes in the wake of MacroGenics’ safety data submission to the American Society of Clinical Oncology (ASCO) for their Annual Meeting presentation, slated for May 31. Despite the data not being accepted for presentation, MacroGenics remains undeterred, promising to unveil further interim data, including updated safety and preliminary efficacy findings, by the end of May. This forthcoming update is eagerly anticipated, given the company’s commitment to also disclose data on radiographic progression-free survival (rPFS), the study’s primary endpoint, in Fall 2024.

The TAMARACK study is noteworthy for its exploration of vobra duo, an antibody drug conjugate (ADC) targeting B7-H3, a protein highly expressed in various tumor types, including prostate cancer. Phase 1 trials revealed significant anti-tumor activity at a dosage of 3.0 mg/kg Q3W, though adverse events necessitated dose adjustments and early treatment discontinuations. The ongoing Phase 2 study aims to refine the dosage to enhance tolerability and effectiveness.

Investment Implications

For traders and investors, this update is a critical juncture. The initial refusal of ASCO to present the abstract may raise eyebrows, but the company’s resolve to share further data suggests confidence in vobra duo’s potential. This scenario presents a nuanced opportunity for investors:

- Short-term volatility may arise as the market digests the implications of the ASCO decision and anticipates the forthcoming data release. Savvy traders might find opportunities in these fluctuations.

- Long-term potential hinges on the updated efficacy and safety data. Success in the Phase 2 study could significantly impact MacroGenics’ valuation, considering the urgent need for effective treatments in mCRPC.

- Strategic collaborations and licensing opportunities could emerge or be strengthened, depending on the data’s impact, potentially opening additional avenues for investment.

Market Watch

Investors and traders should closely monitor MacroGenics’ announcements, particularly the end-of-May data release. This information will not only provide clarity on vobra duo’s safety and preliminary efficacy but also signal the study’s future direction. Moreover, the Fall 2024 update on rPFS will be a pivotal moment, potentially redefining MacroGenics’ role in the mCRPC treatment landscape.

Looking Ahead

MacroGenics’ journey through the TAMARACK study underscores the inherent risks and rewards of biopharmaceutical investments, where data and determination intersect to drive innovation. The company’s dedication to advancing cancer treatment reflects a broader commitment seen across the sector to address complex medical challenges through cutting-edge research and development.

For investors, staying informed and agile will be key as MacroGenics navigates this critical phase. The outcomes of the TAMARACK study could have far-reaching implications for the company, its stakeholders, and, most importantly, patients battling metastatic castration-resistant prostate cancer.