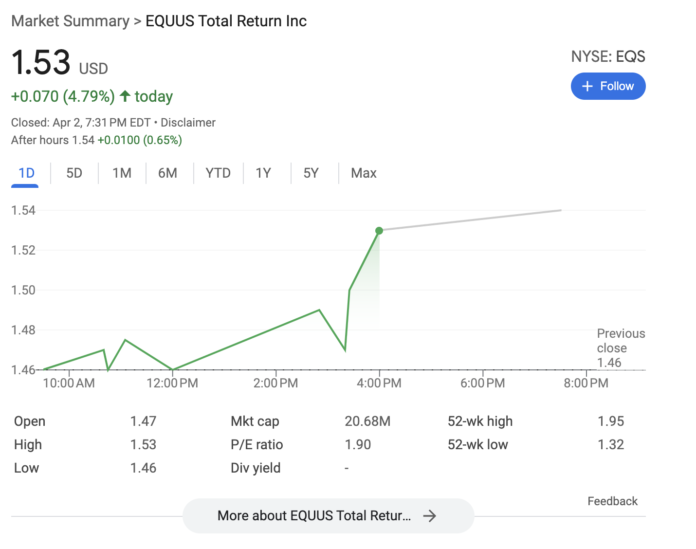

Today, Equus Total Return, Inc. (EQS) witnessed an interesting day in the market. The stock, which closed at $1.50 in the previous session, opened slightly lower at $1.47. Throughout the day, EQS shares fluctuated within a narrow band, reaching a high of $1.53 and dipping to a low of the same $1.47 opening price, before settling in a range that attracted investor attention.

On the trading floor, the bid was placed at $1.35 for 2,200 shares against an ask of $1.54 for 3,100 shares, highlighting a vibrant exchange of shares amidst market participants. This activity unfolded within the backdrop of EQS’s performance over the last year, where it oscillated between a low of $1.32 and a peak of $1.9499, marking its 52-week range.

The volume of shares traded today was reported at 28,060, a notable increase from the average volume of 13,694 shares, indicating a heightened interest in EQS on this trading day. This surge in trading volume might reflect investor reactions to market news or shifts in investor sentiment towards Equus Total Return, Inc.

With a market capitalization of approximately $20.683 million and a Beta (5Y Monthly) of 0.96, EQS demonstrated stability relative to the broader market’s movements. The stock’s price-to-earnings (PE) ratio stood attractively at 1.89, based on trailing twelve-month earnings, suggesting a valuation that could capture the attention of value investors. Additionally, the earnings per share (EPS) for the same period were reported at $0.8100, offering a glimpse into the company’s profitability on a per-share basis.

On February 14, 2024, Equus Total Return, Inc. (NYSE: EQS), a notable player in the investment realm, shared an uplifting update regarding its subsidiary, Morgan E&P, LLC (“Morgan”). This announcement centers around a significant enhancement in Morgan’s asset valuation in the energy sector, following a comprehensive reserve estimate revision by Cawley, Gillespie & Associates, Inc. (“CG&A”), a respected petroleum engineering firm.

Morgan has been actively expanding its footprint in the lucrative Bakken/Three Forks formation within North Dakota’s Williston Basin. Notably, on December 18, 2023, Morgan announced a substantial increase in its holdings in this region, boosting its acreage by 1,229.32 net acres or approximately 25.9%, bringing its total to 5,976.84 net acres. This strategic expansion underscores Morgan’s commitment to strengthening its position in the energy market.

The updated reserve analysis, informed by the latest NYMEX strip pricing as of December 29, 2023, and utilizing a 10% discount rate (PV10 Valuation), reveals significant value across various reserve categories. The values of proved, probable, and possible reserves are now estimated at $31,986,856, $13,898,074, and $62,025,104, respectively. A pivotal aspect of this report is the conversion of possible reserves into proved developed producing (PDP) reserves, amounting to $27,359,924, following the successful completion of two key wells, Baranko 1-28H and Obrigewitch 1-33H. These wells, drilled into the Middle Bakken formation, have achieved total depths of 19,920 and 21,356 feet, respectively, and have been completed with 60-stage fracture stimulations, now in the flowback phase.

This conversion has led to a remarkable 135% increase in the value of proved reserves, from the previously announced $13,575,442 million of proved undeveloped (PUD) reserves to $31,986,856 million, of which $27,359,924 million is classified as PDP and $4,626,930 million as PUD.

Furthermore, CG&A’s analysis supports the potential for forty-six (46) gross drilling locations, an increase from the previously drilled wells, with Morgan’s net drilling locations also rising from fifteen (15) to eighteen (18). This expansion reflects the ongoing efforts to secure additional net acreage and working interests, which is anticipated to further increase the number of net drilling locations.

CG&A’s assessment also highlights an estimated ultimate recovery (EUR) of approximately 814,000 barrels of oil equivalent from a single well, showcasing the promising potential of Morgan’s assets. This development positions Morgan E&P, LLC, and by extension, Equus Total Return, Inc., on a path of significant growth and reinforces their standing in the North American energy sector.

Source: https://finance.yahoo.com/news/equus-subsidiary-morgan-e-p-134500786.html